Trump's Attempt To Control the Federal Reserve

The politicized firing of Fed Governor Lisa Cook threatens the tradition of central bank independence and could destabilize the American economy

President Trump this week took the unprecedented step of trying to fire Lisa Cook, a member of the Federal Reserve Bank’s Board of Governors, as he continues his campaign to assert influence over the central bank and reduce its independence. Trump has been railing for the bank to lower interest rates for months, repeatedly attacking and pressuring Fed Chair Jerome Powell. Powell has stood pat so far, much to Trump’s chagrin.

The firing of Cook – if it stands up in court, which is not a sure bet – would give Trump the ability to replace her, converting his appointees into a majority of the seven-member Board of Governors. That would give Trump more levers to directly influence central bank policy in ways that haven’t occurred since the Fed’s independence from the Treasury in 1951 (before that, the Department of Treasury pressured the Fed to keep interest rates low to ease government borrowing, which helped to finance spending sprees like during World War II but which also contributed to inflation). It would mark a serious departure among advanced democracies of central bank independence and could threaten the stability and status of the American economy.

The Attempted Hijacking of the Fed

The ostensible reason for Trump’s actions came from an allegation of mortgage fraud provided by the Trump-appointed director of the Federal Housing Agency, Bill Pulte. Pulte sent a letter to the Department of Justice that Cook took out mortgages in Georgia and Michigan close to one another while claiming both as a primary residence (which could generate more favorable lending terms).

The allegations strike as selective, pre-emptive, and politicized targeting. Pulte has raised similar allegations against two other prominent Democrats and Trump opponents. The allegations have not yet resulted in legal charges against her – let alone convictions – nor do they clearly constitute “cause” for removal, which is required by law. Cook makes precisely that case in a lawsuit against Trump to retain her position: that due cause for removal should imply some malfeasance, neglect, or misconduct in her official duties. That is going to be taken up now by the courts, and will likely end up at the Supreme Court, which has recently expanded executive powers, including removal powers. If Trump wins, he will notch yet another victory for enlarged executive power.

Why Central Bank Independence Matters

Control over monetary policy gives central banks the ability to impact inflation and employment as well as overall economic growth and financial stability. Research indicates that central bank independence is associated with lower inflation rates and lower unemployment.

Those powers – and their political consequences – are tempting for politicians to want to control. For an incumbent that seeks to stoke the economy in advance of elections or to shore up sagging popularity, fiddling with monetary policy is an attractive option. For Trump, lowering interest rates could goose the economy at a time when it is facing headwinds from new tariffs and recent job reports suggesting flagging employment. (The downward revision in employment numbers itself caused Trump to fire the head of the Bureau of Labor Statistics.)

But forcefully pushing for short-term economic gains can generate long-term problems. Not only can it encourage inflation, but it also reduces trust among investors over whether a country will make fiscally sound data-driven long-run decisions. That can push up borrowing rates and raise national debt.

Central Bank Independence Around the World

History is littered with examples of politicized central banks doing the government’s bidding only to sacrifice broader economic stability. Latin American governments in the 1960s and 1970s printed money in abandon to finance government spending goals, only to suffer massive economic shocks, inflation, and debt crises in the early 1980s. Turkey’s President Recep Tayyip Erdogan spent years badgering its central bank to keep interest rates low, repeatedly firing central bankers who tried otherwise, only to have inflation spike and to finally relent to more orthodox monetary policy.

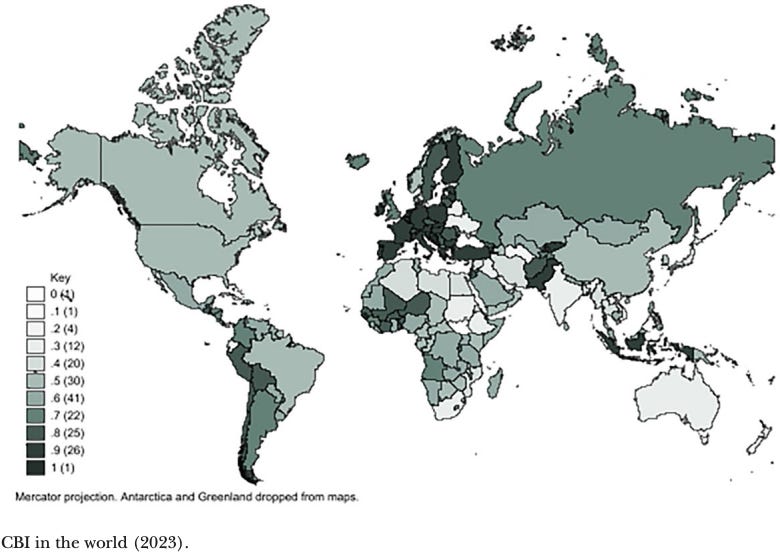

The fact that politicized monetary policy has repeatedly led to major economic problems helps to account for the fact that central banks around the world have gained increasing independence over time. Since the end of the 1990s, most central banks have enjoyed considerable independence (see map below; central bank independence scale runs from 0–1, with 1 indicating maximum independence). Independent policy formulation in particular dramatically advanced since the 1970s.

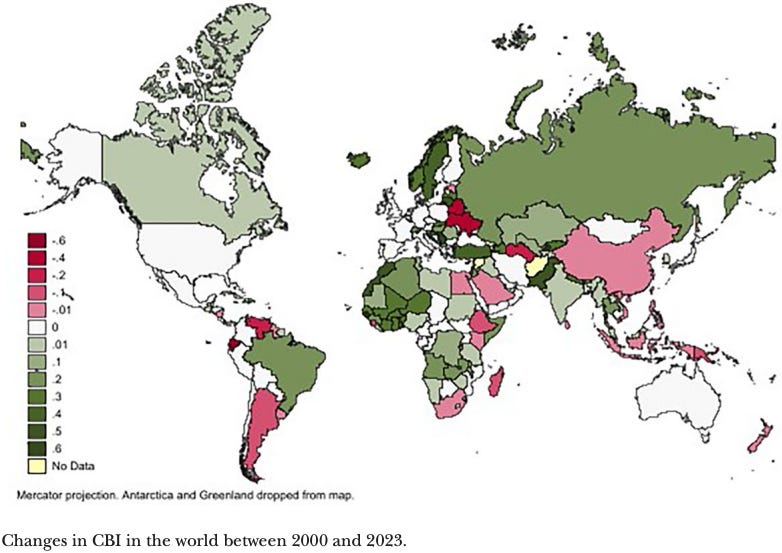

Gains in central bank independence have advanced in the last two decades as well, though unevenly (see map below). Advanced democracies have essentially uniformly maintained their levels of central bank independence or enhanced them. Central bank independence has also advanced in places that have undergone structural economic adjustment programs or opened their economies to a greater degree to international trade flows.

The Troubling Link Between Authoritarianism and Central Bank Intervention

Despite the overall picture of increasing central bank independence, a number of governments have intervened in their central banks to reduce their autonomy (see previous map). Many of these governments, most notably in places like China, Belarus, Egypt, Venezuela, and Nicaragua, are authoritarian ones. Even right-wing populists like Victor Orban that are ideological heirs to free-market predecessors have attacked central banks.

Authoritarians view banks as they do many other institutions: as objects of control for political ends. Trump’s move to fire Cook from the Fed, as he did the head of the Bureau of Labor Statistics when she released numbers he didn’t like, is in this vein. His aim to influence policy at the Fed, if he is successful, could in fact help him to cover over the cracks in the economy by incentivizing borrowing and investment. But if that comes to pass, Americans will be left holding the bag in the long term.

Leading image is of Lisa Cook being sworn in to the Federal Reserve Board of Governors (image under CC license 1.0). The maps of central bank independence are from Garriga, Ana Carolina. "Revisiting central bank independence in the world: An extended dataset." International Studies Quarterly 69, no. 2 (2025).